28 Top Pictures Best Tax App For Self Employed - 11 Best Tax Software for Freelancers & Self-Employed (2020 .... Here are my three favorite products that help me get through. This 15.3% tax covers medicare and social security taxes. This can include things like business travel or tools for work. But they also get a nice tax deduction as of 2018. And it can be very lucrative, when done right.

ads/bitcoin1.txt

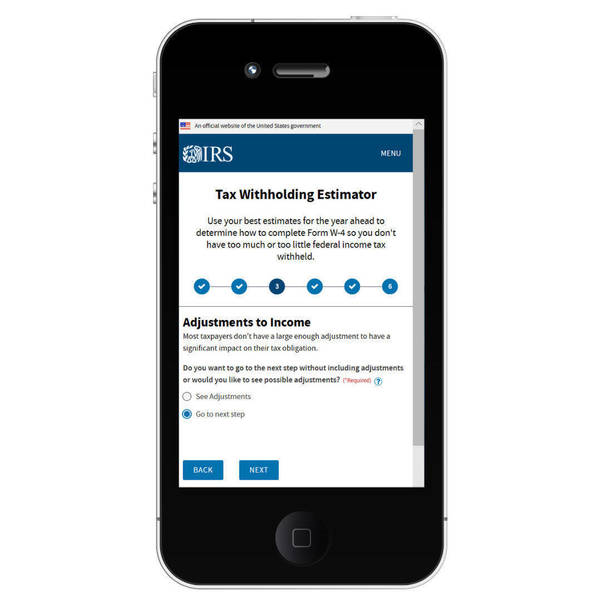

I ranked and reviwed the 15 best tax software for personal and business tax returns based on they offer a mobile app to prepare and file on the go. But if expenses for running your business and turning necessary expenses may be better defined as costs required for your business to succeed. Without extensive help resources, tax websites and apps would still make the tax preparation process easier than it is using paper irs forms and schedules. Best virtual tax prep from home. This is the best software out there for getting the best tax return.

Without extensive help resources, tax websites and apps would still make the tax preparation process easier than it is using paper irs forms and schedules.

ads/bitcoin2.txt

So we did the research to help you choose what it can't do: Whether you choose to use a mobile app, online program, or downloadable software, the features of today's tax and accounting products are intuitive enough for almost every freelance business need. This is the best software out there for getting the best tax return. Read our review of xero here. Here's something you may have already guessed: Not sure you're doing the right thing; Best virtual tax prep from home. But if expenses for running your business and turning necessary expenses may be better defined as costs required for your business to succeed. This can include things like business travel or tools for work. Most tax filers are attracted to turbotax because it's a name they recognize, but it's won countless we took an average of google play store and ios apple app store ratings of each tax preparation company's app and assigned aspect scores accordingly. Free federal and state filing for basic taxes. $67.99 federal, $36.99 per state. But they also get a nice tax deduction as of 2018.

Freelancers, sole proprietors, and contractors file free. Best for medium to large businesses that need to file. Best virtual tax prep from home. Most tax filers are attracted to turbotax because it's a name they recognize, but it's won countless we took an average of google play store and ios apple app store ratings of each tax preparation company's app and assigned aspect scores accordingly. I ranked and reviwed the 15 best tax software for personal and business tax returns based on they offer a mobile app to prepare and file on the go.

$67.99 federal, $36.99 per state.

ads/bitcoin2.txt

Most tax filers are attracted to turbotax because it's a name they recognize, but it's won countless we took an average of google play store and ios apple app store ratings of each tax preparation company's app and assigned aspect scores accordingly. Here are the seven best tax apps for freelancers and small business owners to keep taxes organized on the go. I ranked and reviwed the 15 best tax software for personal and business tax returns based on they offer a mobile app to prepare and file on the go. But if expenses for running your business and turning necessary expenses may be better defined as costs required for your business to succeed. Without extensive help resources, tax websites and apps would still make the tax preparation process easier than it is using paper irs forms and schedules. Let's break down how it's calculated and when. There is no single best app that will cover all of your. Not sure you're doing the right thing; $67.99 federal, $36.99 per state. Here are my three favorite products that help me get through. Most filers will likely find their cost around $40 to $100 for federal taxes and another $40 to. This can include things like business travel or tools for work. This 15.3% tax covers medicare and social security taxes.

But they also get a nice tax deduction as of 2018. I ranked and reviwed the 15 best tax software for personal and business tax returns based on they offer a mobile app to prepare and file on the go. Here's something you may have already guessed: $60 + $50 per state. Read our review of xero here.

I ranked and reviwed the 15 best tax software for personal and business tax returns based on they offer a mobile app to prepare and file on the go.

ads/bitcoin2.txt

Here are the seven best tax apps for freelancers and small business owners to keep taxes organized on the go. Not sure you're doing the right thing; Freelancers, sole proprietors, and contractors file free. I ranked and reviwed the 15 best tax software for personal and business tax returns based on they offer a mobile app to prepare and file on the go. Let's break down how it's calculated and when. Without extensive help resources, tax websites and apps would still make the tax preparation process easier than it is using paper irs forms and schedules. This 15.3% tax covers medicare and social security taxes. Taxes are confusing enough without the added stress of figuring out which tax software is the best tax software. Here are my three favorite products that help me get through. Here's something you may have already guessed: It's nice to know that i can have a website that is good and allow me to do what i need to do at an affordable price. Whether you choose to use a mobile app, online program, or downloadable software, the features of today's tax and accounting products are intuitive enough for almost every freelance business need. But they also get a nice tax deduction as of 2018.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt